What You Need To Know About Mergers & Acquisitions: 12 Key Considerations When Selling Your Company

What You Need To Know About Mergers & Acquisitions: 12 Key Considerations When Selling Your Company

Individuals working closely with legal advisers to take a deal from concept to close need to understand the legal concepts that drive the documentation of the deal. The author illuminates the essential structuring issues by discussing key agreements and critical clauses within those agreements and by narrating fictional stories of deals gone bad because of legal omissions. Merging business, finance, and law, this insightful examination of M&A strategy is designed to help you understand M&A negotiations and the ways in which the final outcome affects your financial future. A general overview of an acquisition agreement framework segues into a more detailed discussion of different deal structures, including stock sales, mergers, asset sales, and complex structures, giving you the information you need to know when each one applies best in practice.

This working capital mechanism, if not properly drafted or if the target amounts are improperly calculated, could result in a significant adjustment in the final purchase price to the detriment and surprise of the adversely affected party. Christopher Harrison combines business, finance, and legal expertise to provide an essential and highly accessible overview of the complicated and often labyrinthous M&A process.

Take due diligence to the next levelwith a fact-based,rigorously quantified assessmentthat helps ward off deal fever, spot synergies the market didn’t see and prepare for integration long before the deal is inked. The quantitative research reviewed the financial performance and M&A activity of 1,729 publicly listed manufacturing and service companies from 2007 through 2017.

Through synthesizing and integrating diverse theoretical perspectives on the functioning of firm executives, this article advances a sequential mediation process model to link CEO attributes with firm performance. The model incorporates CEO emotion and cognition, along with top management team (TMT) and organizational processes as multilevel mediating mechanisms linking CEO attributes to firm performance outcomes. In addition, we draw from event system theory to highlight contextual events confronting firms and CEOs that alter the sequential mediation process resulting in stronger/weaker effects of CEOs on firm performance. Our research not only extends the literature by addressing what, how, and when CEO attributes impact firm performance in a more holistic fashion but also identifies meaningful theoretical and methodological opportunities for research advancement. Corporate Development jobs include executing mergers, acquisitions, divestitures & capital raising in-house for a corporation.

All told, activists aimed their attention at more than 800 companies globally in 2018, including Dell, Whitbread, Sky, Danone, Hyundai, Thyssenkrupp, Olympus, Micro Focus and Teva. To cite an example, Unilever was a recent beneficiary of this liquidity enabled by private equity. When it announced its intention to divest its spreads (margarine and butter) business back in 2017, there were limited prospects of finding eager corporate buyers, but a number of PE firms showed interest and competed in multiple rounds. This ultimately concluded with an approximate $8 billion sale to global investment firm KKR in one of the biggest leveraged buyouts of the year.

M&A Modeling Course

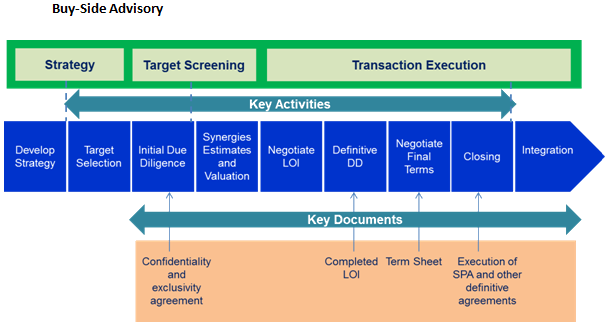

The most common career paths to participate in M&A deals are investment banking and corporate development. Attorneys for the target decide whether to negotiate, refuse the buyer’s overtures, sell, or do a deal with another company. Other key terms to be included in the acquisition agreement (discussed in the next section below). The selling company needs to have prepared for the buyer’s review an extensive list of all IP (and related documentation) that is material to its business.

The challenges associated with making scope deals successful are large, and they’re different than the challenges of more traditional scale deals. As we survey what companies around the world are dealing with in the rough and tumble M&A arena, we observe four other trends. The year 2018 set a near record for M&A, driven by momentum in the first half even as the last quarter slowed down.

The emerging approach of portfolio investing requires a reevaluation of the acquirer’s broader operating model. The acquirer should avoid burying assets within the existing base business or subjecting them to processes that hinder growth and innovation. Different cultures and talent pools need to be managed more autonomously—all this while ensuring that the asset can still benefit from the acquirer’s infrastructure and capabilities to enable growth. Nestlé acquired a majority stake in California-based Blue Bottle Coffee, an artisanal coffee chain with about 40 stores in the US and Japan, for roughly $500 million, and Texas-based Chameleon, an organic cold brew producer. The acquisitions of these insurgent brands strengthen Nestlé’s presence in the fast-growing premium coffee segment as consumer preference shifts toward high-quality, sustainable coffee.

- With digital transformation front and center on the IT agenda for most companies, simultaneous integration leads to competition for resources.

- Acquirers in transactions with earnouts are significantly more likely to be financially constrained, face tighter credit market conditions, and use less debt and equity to fund acquisitions.

- The representations regarding unaudited financial statements are typically qualified to the effect that footnotes required by GAAP have not been included in the unaudited financial statements, and that there may be immaterial changes resulting from normal year‑end adjustments in a manner consistent with past practice.

- Consumer goods companies face unique risks when integrating smaller brands—for example, paying too much up front, scaling them too quickly, burdening them with business processes and planning, and losing critical talent.

- If there is a material adverse effect on the business or financial condition of the target company after the merger agreement is signed but prior to the closing, the acquiring company will not be required to close.

- Although it is tempting to resist bringing on a “large” legal team out of concern that they will generate a large legal bill, experienced specialists will actually save you money by identifying significant risks early in a transaction and working to develop practical solutions.

We examine the effect of institutional voids in capital markets on individual transactions in emerging economies, focusing on M&A deals that were abandoned after being publicly announced. M&A deals may fall through when unexpected information is brought to light or financing difficulties arise. At the country level, capital market development can lower the probability of M&A deal abandonment by facilitating the flow of information and capital. At the firm level, when acquirers are affiliated with business groups, development of internal capital markets can also lower this probability, facilitating completion of the transaction and the flow of information.

By considering overall deal economics and other synergistic benefits, the company ultimately chose not to proceed with the acquisition. Of the two types of scope deals, the most dramatic growth has been in those aimed at acquiring new capabilities. Capability M&A has increased to represent roughly 15% of all strategic deals valued at more than $1 billion in 2018, compared with 2% in 2015 (see Figure 2.2).

When the firms were “merged,” participants from the acquiring company who role-played as managers were able to communicate much more effectively with subordinate participants from their own firm than with those from the other firm. Sometimes, the person in the manager role grew impatient with the subordinate from the acquired company.

Considerable research has been devoted to examining the factors that influence postacquisition performance. Yet the empirical evidence remains inconclusive as to the extent to which these factors affect postacquisition performance.

As discussed in response to question 4.4, it remains difficult for a buyer to prove that a material adverse effect has occurred on the business or financial condition of the target company, and to avoid its obligation to close on that basis. Merger agreements may also include so-called “reverse termination fees” that penalise acquirers who do not complete transactions.

With digital transformation front and center on the IT agenda for most companies, simultaneous integration leads to competition for resources. Good prudence suggests minimizing the risks—when it comes to deciding between integration and digital transformation efforts, the former should take priority. Systems integration typically takes two to three years to execute fully, however, and the business often can’t wait that long for critical technological capabilities, such as cloud infrastructure, robotic process automation, wide area network and analytics capabilities. In our experience, to make progress in parallel to integration efforts, the best acquirers insulate their digital agenda by protecting the resources and budgets allocated to the top digital initiatives. Experience teaches us that process and systems integration done right, with the appropriate investments of resources and budget, builds a solid foundation for the future.

We hypothesize and find evidence in a sample of 14,000 Italian companies that acquisitions are more likely to occur among firms with similar owners. We show that acquirers with low institutional ownership, high deal risk, and high agency costs are more likely to bypass shareholder voting.

What You Need To Know About Mergers & Acquisitions: 12 Key Considerations When Selling Your Company

Author Christopher Harrison illustrates the ideas by showing more than 140 examples of the typical wording of these concepts in the legal documents. CHRISTOPHER S. HARRISON currently serves as Chief Investment Officer of The Falconwood Corporation, a financial management firm and research laboratory that has incubated and operated numerous highly successful financial and technological ventures.

Если нет навыков торговли на форекс, то для начала стоит попробывать свои силы в бонусных программах брокеров, поискать можно тут https://форексбезвложений.рф/, а уже потом пробовать вкладывать средства.

ОтветитьУдалить